Data & Code & Blog

Job Market Paper

[1] “Taxes and Non-debt Financing: Evidence from Trade Credit”

- Stage: Under review, The Accounting Review

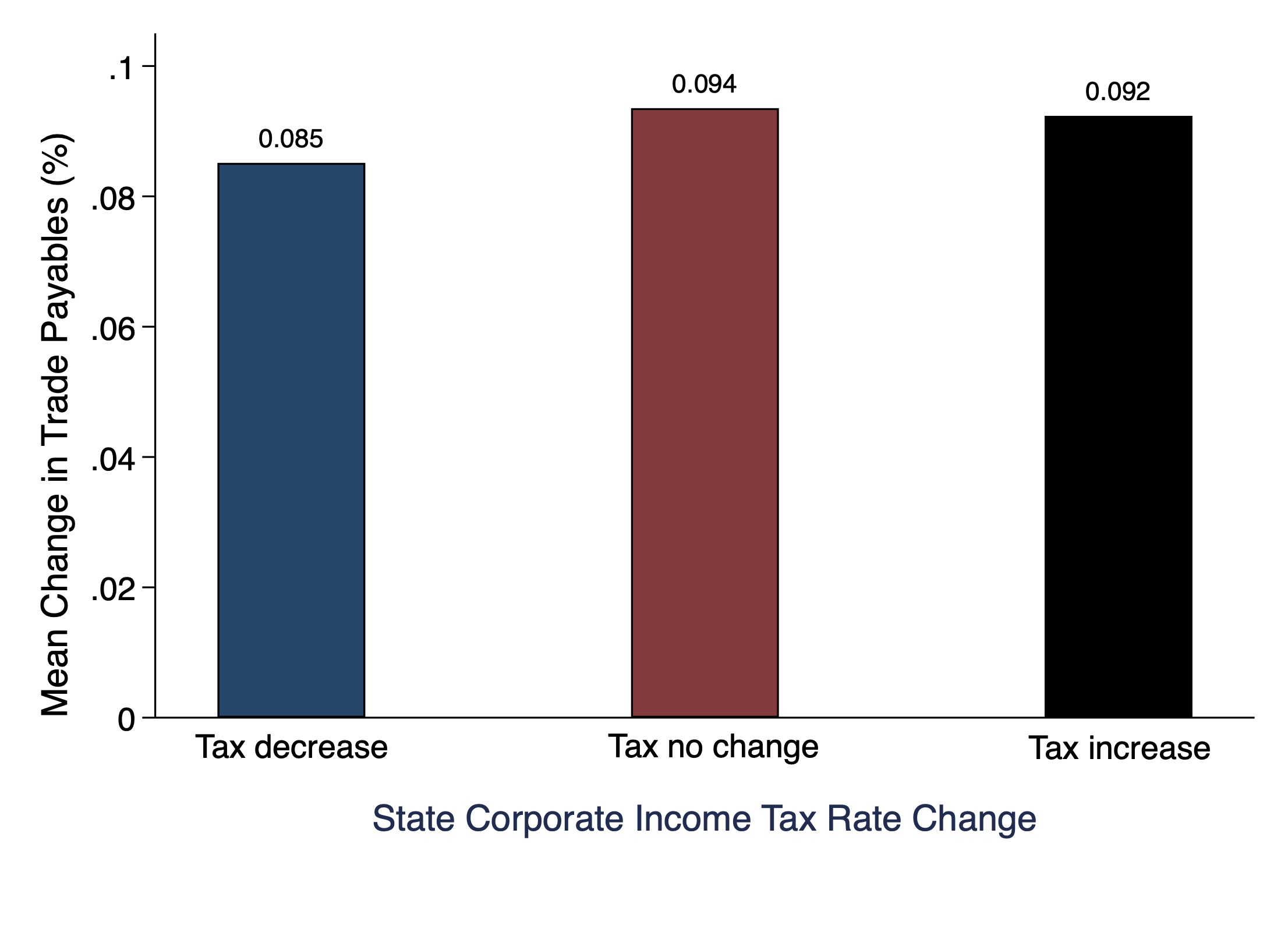

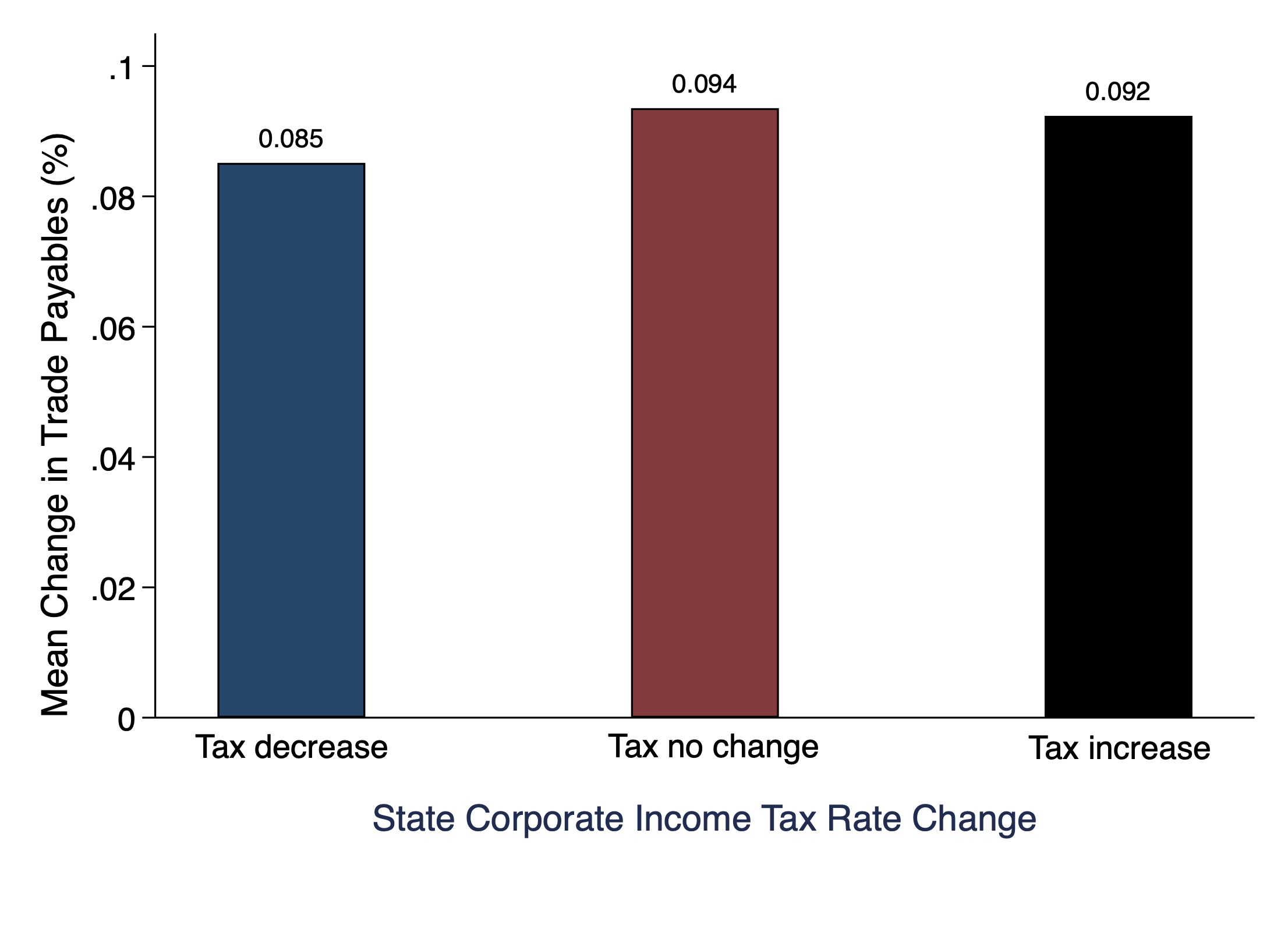

- Brief: Analyzing state-level corporate income tax rate changes from 1998 to 2018, the result shows both tax increases and decreases result in reduced trade credit usage, particularly for firms with fewer covenant violations and better ex-ante liquidity positions. Analysis of customer-supplier data suggests that customer trade credit adjustments drive these effects, and reduced trade credit reliance propagates from treated states to other states through supply chain networks.

Working Papers

[1] “Unraveling the Pooling Equilibrium: How the Introduction of ASC 842 Triggers a Reallocation of Trade Credit”

- Stage: 1st R&R at The Accounting Review

- With Travis Chow (HKU), Doyeon Kim (HKU), and Guochang Zhang (HKU)

- Brief: ASC 842 disrupts the previous pooling equilibrium, leading to a reallocation of trade credit. Firms with minimal impact on their financial reporting stand to benefit from this shift.

[2] “Taxes and Non-debt Financing: Evidence from Trade Credit”

- Stage: 1st R&R at The Accounting Review

- Brief: Both state corporate income tax rate increases and decreases result in reduced trade credit usage. This effect is primarily driven by adjustments in customer trade credit practices, which then propagate through supply chain networks.

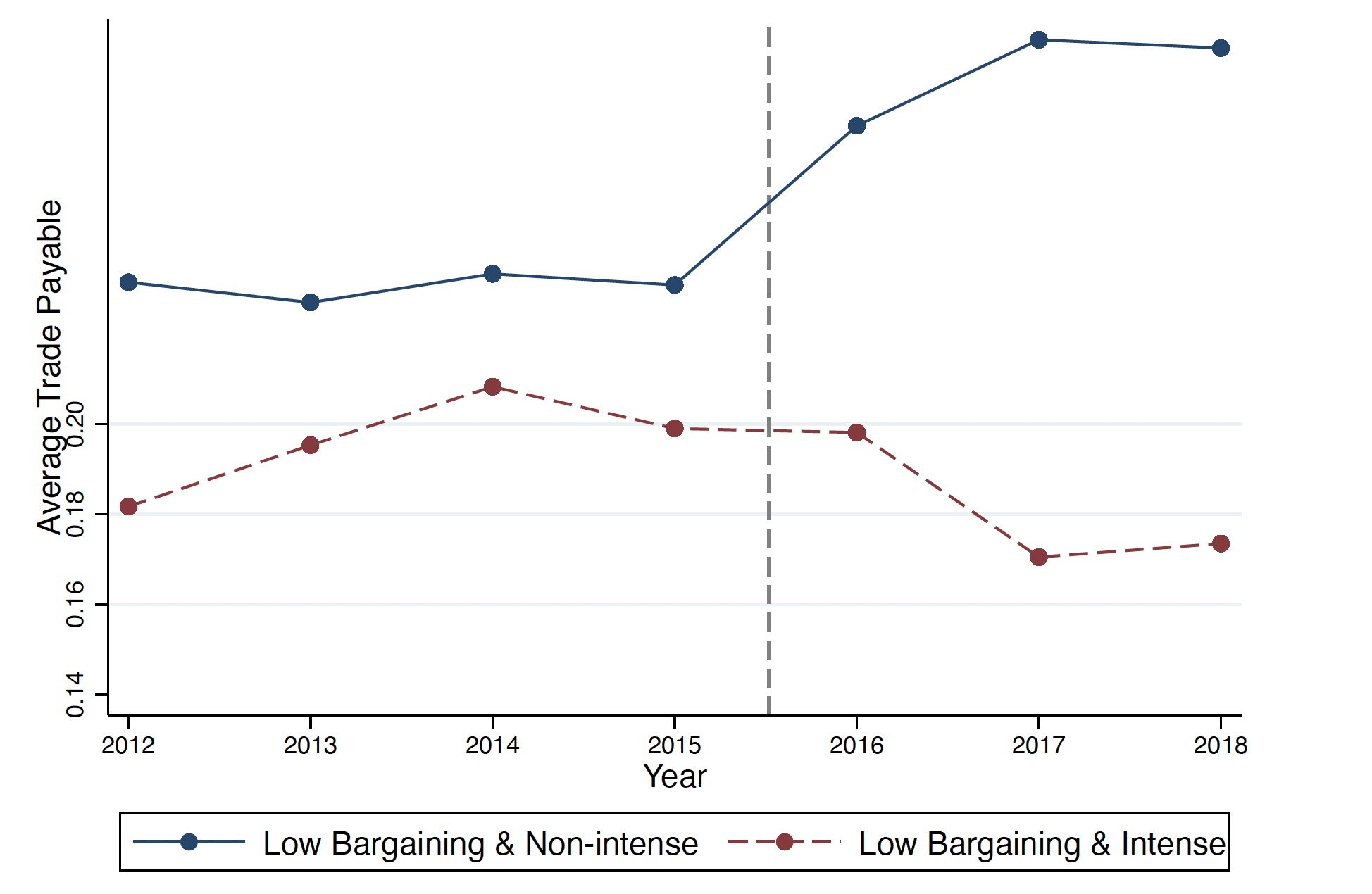

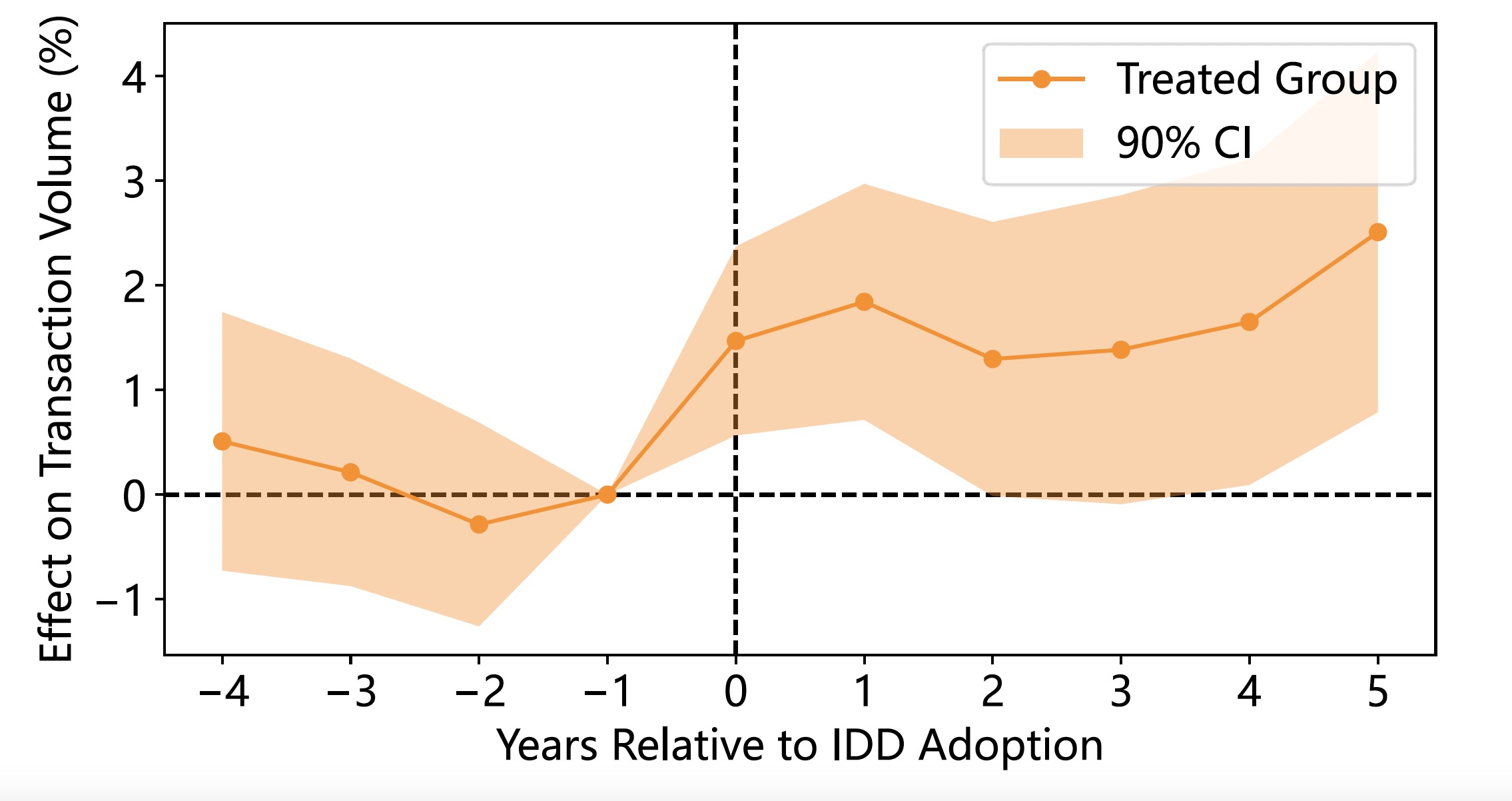

[3] “Proprietary Costs and Supply Chain Collaboration”

- With Wenzhi Ding (PolyU HK), Guoman She (HKU), and Guochang Zhang (HKU)

- Brief: The mobility of customers' key employees poses a significant threat to supplier proprietary costs and thus shapes supplier-customer arm's-length transactions.

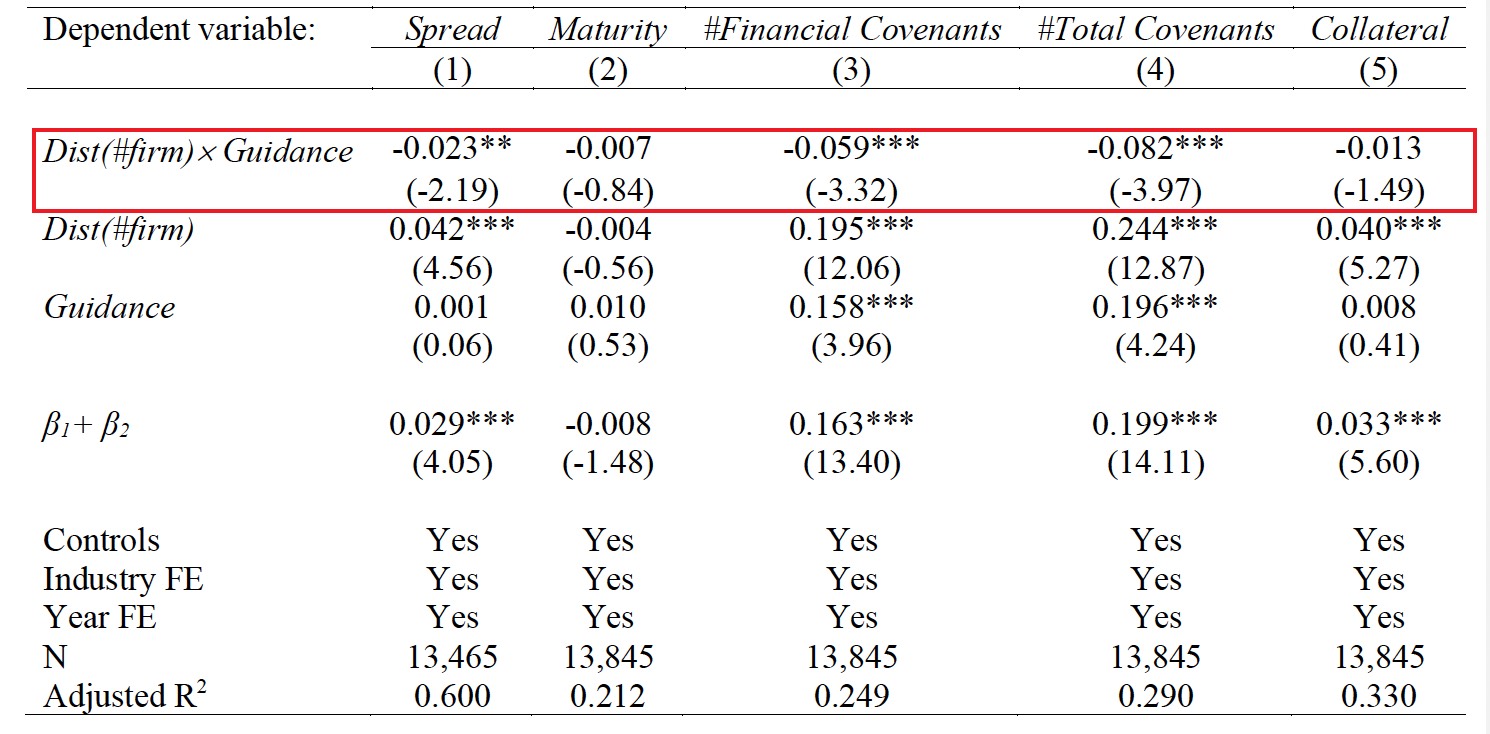

[4] “Filling the Monitoring Void: Lead Arranger Distraction and Borrower Disclosure”

- With Derrald Stice (HKU)

- Brief: We predict and find that borrowers with distracted lead arrangers will increase public disclosure to satisfy the information needs of non-lead arranger loan participants.

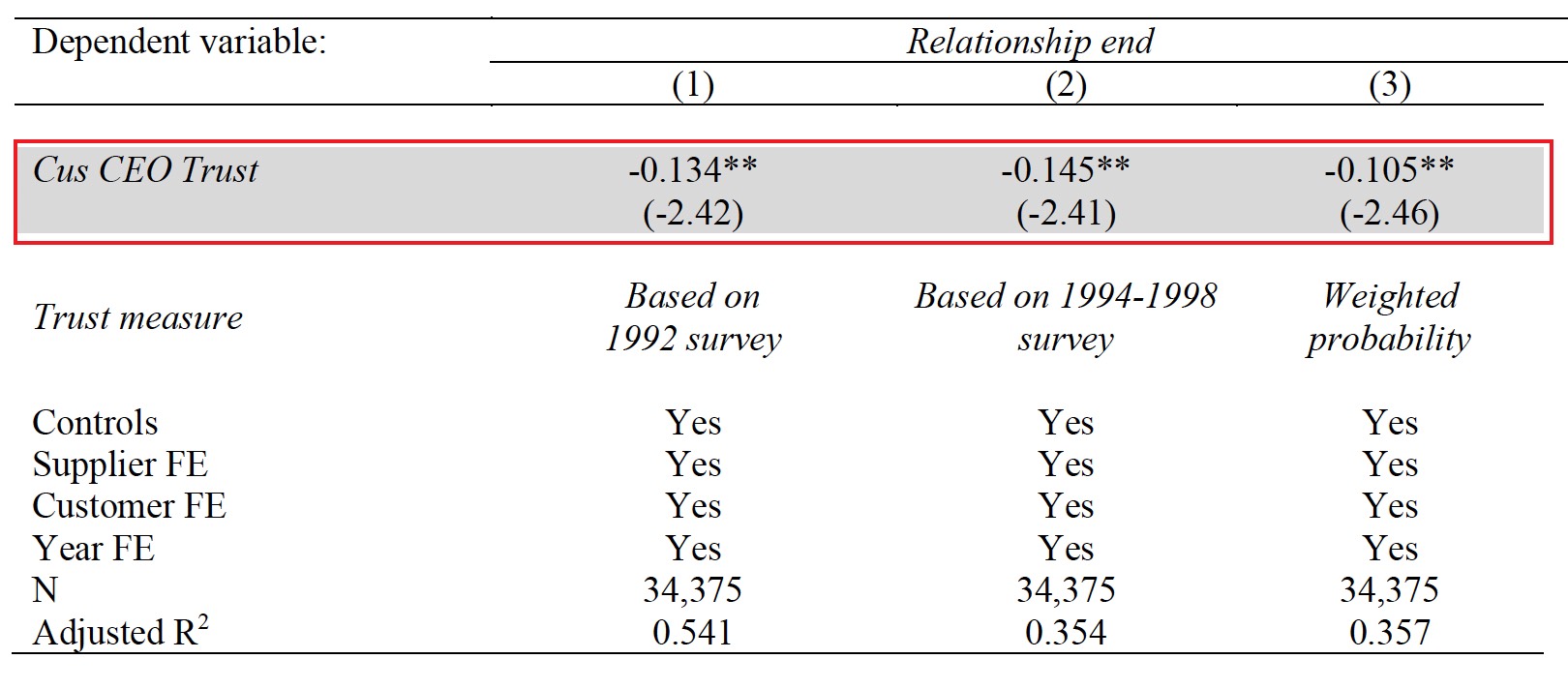

[5] “Unilateral Trust and Buyer-Supplier Disruption”

- With Yangyang Chen (CityU HK), and Cuili Qian (UT Dallas)

- Brief: CEO-inherited trust complements formal contracts and mitigates supply chain disruptions.

Selected Research in Progress

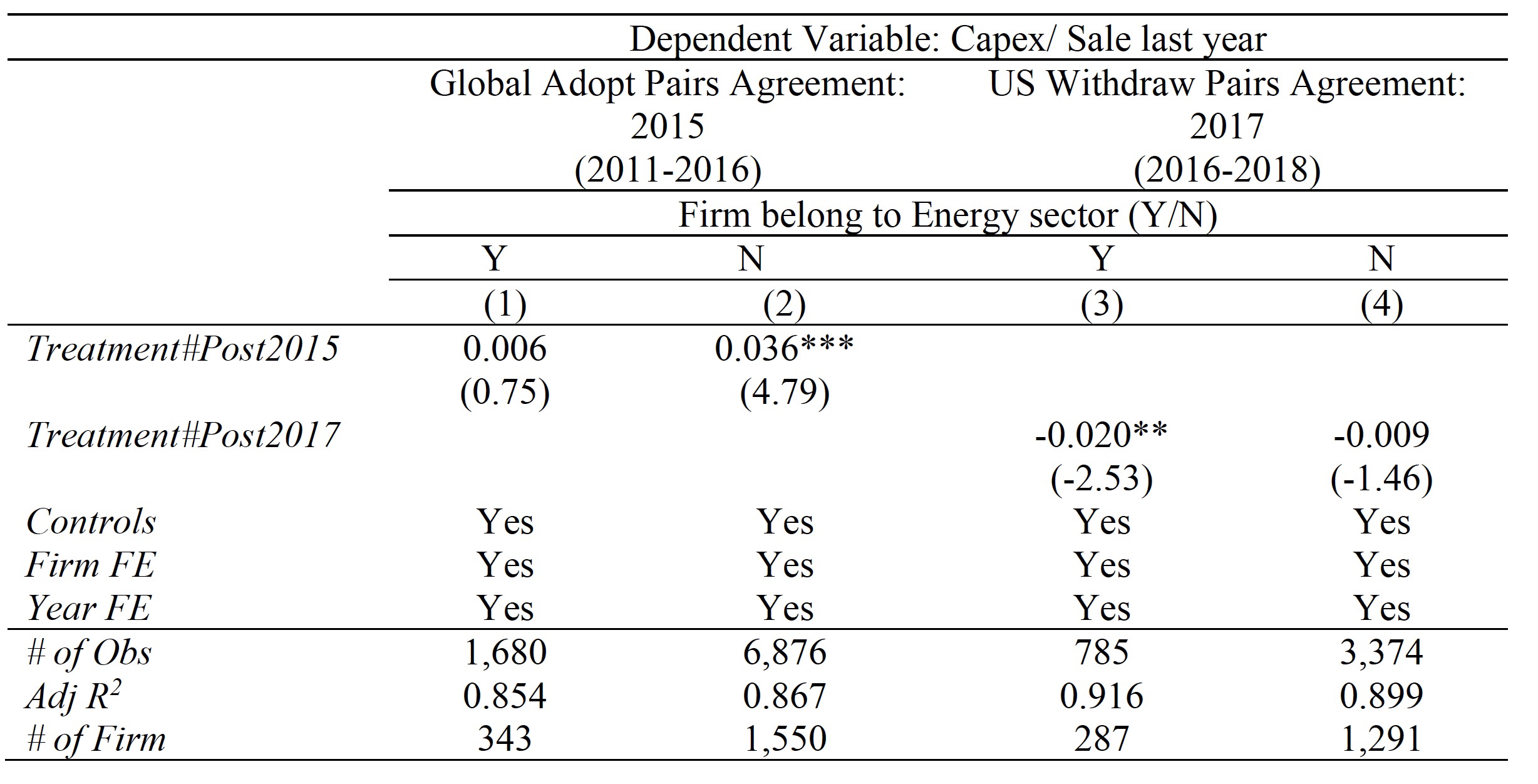

[1] “Climate Policy Uncertainty and Corporate Investment”

- With Menghan Wang (HKU)

- Brief: Using the Pair Agreement and the US exit from the Agreement as a shock to the climate policy uncertainty, we find that corporate investment negatively correlates with the increase and decrease in climate policy uncertainty. However, the energy sector shows an asymmetric response to the uncertainty, indicating their sensitivity to policy changes. This effect is more pronounced for firms that have ex-ante higher climate-related opportunities and ex-post climate-related exposure risks.

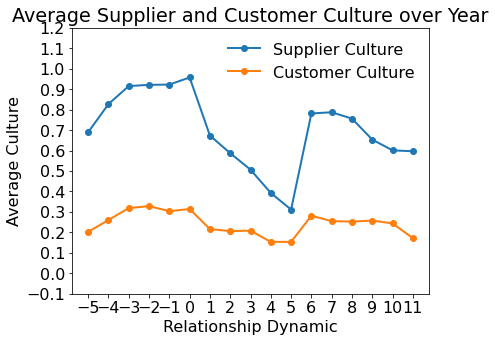

[2] “Supplier-Customer Culture Proximity and Supplier Selection”

- With Charles Kang (HKU)

- Brief: We leverage the Factset Supply Chain database to pinpoint the inception year of customer-supplier relationships spanning from 2001 to 2019. By employing the TNIC code, we discern the top 10 peers, and employ the Mahalanobis distance method to ascertain the pseudo supplier. Our findings indicate that potential suppliers exhibiting a higher degree of cultural proximity are more likely to evolve into actual suppliers in the future.

[3] “Socially Responsible Suppliers: Evidence from Tax Transparency along Supply Chain

- With Travis Chow (HKU)

Selected Publication (Science Domain)

[1] Li, X.; Pei, Y.; Zhang, Y.; Liu, Y.; Fu, W.; Li, J.; You, H.; Huang, J., Single-molecule mechanical unfolding of AT-rich chromosomal fragile sites DNA hairpins: Resolving the thermodynamic and kinetic effects of single G-T mismatch. The Journal of Physical Chemistry B, 2020, 124, 42, 9365–9370.

- Featured as Cover Article, first author

- Rank 36 out of 131 in category Materials Science, SCOPUS JOURNAL METRICS (2022)