Job Market Paper

Are Private Firms Disadvantaged vis-à-vis Public Firms in the Trade Credit Market?

- Solo-authored, 2024

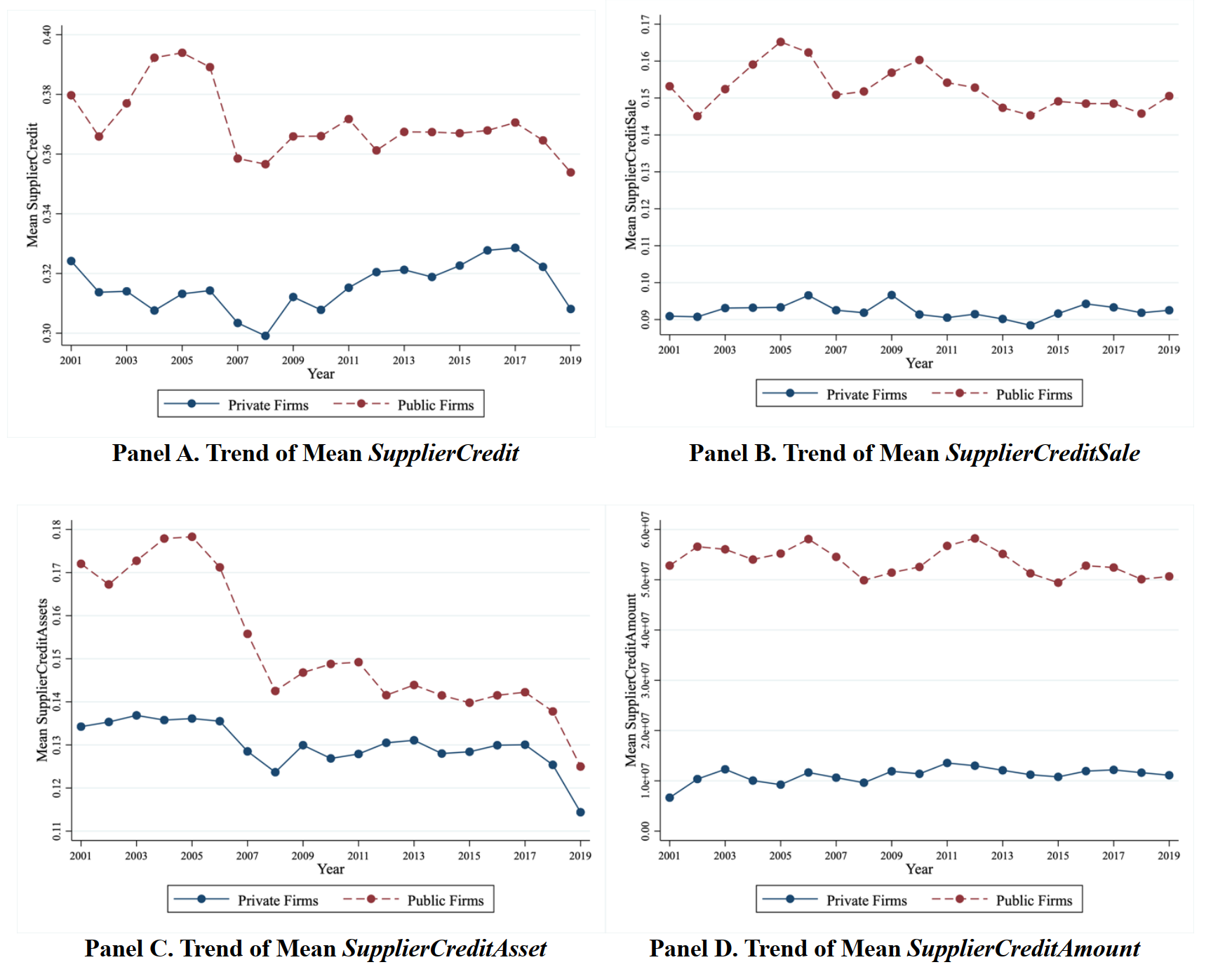

- Updated Abstract: I find that private firms in the European Union receive significantly less supplier credit than public firms, contrary to conventional view that private firms rely more on it for financing. I posit that public listing commits firms to higher level of disclosure, reducing suppliers’ perceived risk and raising their willingness to extend credit. Using the mandatory adoption of IFRS for public firms as a shock enforcing this commitment, I find a significantly negative spillover effect on supplier credit for private firms, particularly those with higher default risk and greater credit demand. This finding cannot be explained solely by the incremental information effect, suggesting the dominant and non-fully substitutable nature of the commitment effect in this context. Reverse regulatory shocks that enhance private firms’ commitment show negative but weaker spillover effects on public firms. Overall, my evidence shows that disclosure commitment disadvantages private firms in the trade credit market, revising the understanding of their access to credit and reconciling debates on the role of public disclosure in trade credit decisions.

(The draft is available upon request, and comments and suggestions are welcome)